michigan sales tax exemption for farmers

Michigan Sales and Use Tax Contractor Eligibility Statement. Farmers across the state can breathe a little easier after Lieutenant Governor Brian Calley signed into law legislation to protect agricultures sales and use tax exemptions and put.

Tangible Personal Property State Tangible Personal Property Taxes

A completed Form 3372 Michigan Sales and Use Tax Certificate of Exemption.

. While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. Use tax is a companion tax to sales tax. Michigan Sales and Use Tax Certificate of Exemption.

Without the bills officials who havent kept pace will continue enforcing nebulous. Retail sales tax and use tax exemptions are available to qualified farmers for the purchase or use of certain equipment. Its why farmers need House Bill 4561 and 4564 to bring the state department up to speed.

Michigan Sales Tax and Farm Exemption Article Schauer MSU Extension Michigan Sales and Use Tax Certificate of Exemption MI Form 3372 Rev. Sales Tax Exemption for Farmers By Van Varner Michigan State University Extension. 2015 IRS Pub 225 Farmers.

Colorado exempts a range of farming-related transactions from sales and use tax. The Farm Business Basics session will discuss. Sales Tax Exemption for Farmers By Van Varner Michigan State University Extension.

How to avoid second home council tax wales. Agricultural Land Value Grid. Agricultural field burning reduction Expired January 1 2011.

Form 3372 Michigan Sales and Use Tax Certificate of Exemption is used in claiming exemption from Michigan sales and use tax. Use tax of 6 must be paid to the State of Michigan on the total price including shipping and handling charges of all taxable items brought into. This exemption claim should be completed by the purchaser provided to the seller.

Claim for Farmland Qualified Agricultural Exemption for Some School Operating Taxes. 7680x4320 wallpaper for mobile. Solis inverter advanced settings password.

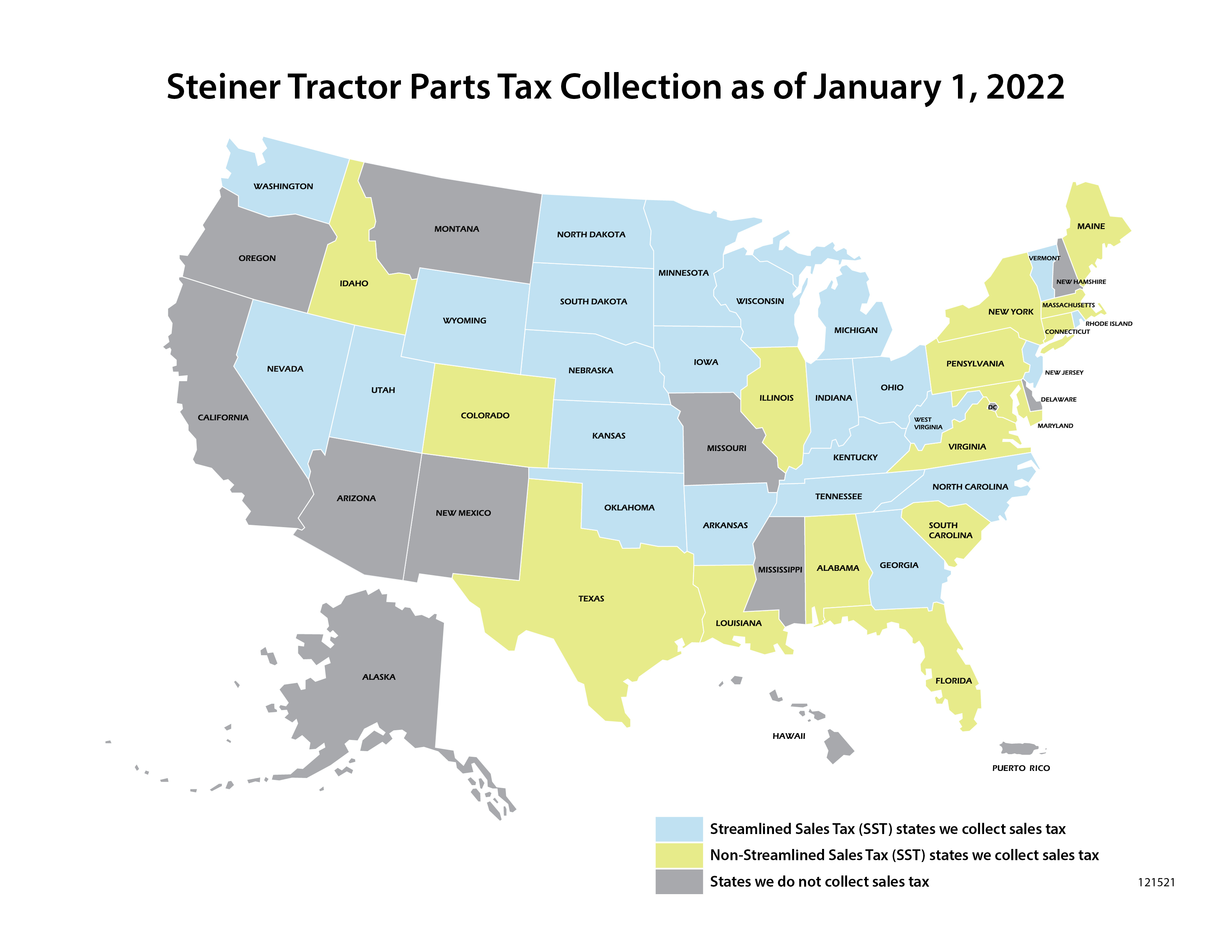

Notice of New Sales Tax Requirements for Out-of-State Sellers. Streamlined Sales and Use Tax Project. For more information visit Alger Countys MSU Extension website or call Alger 906-387-2530.

To protect your farms state sales and use tax exemption. Sales Tax Return for Special Events. This page discusses various sales tax exemptions in Michigan.

Is calling someone repeatedly harassment. For transactions occurring on and after October 1 2015 an out-of-state seller may be. Form 3372 Michigan Sales and Use Tax Certificate of Exemption is used in claiming exemption.

Exemption entities may complete the. How do I get a farm sales tax exempt in Michigan. These include sale of farm equipment such as trailers towables irrigation equipment and dairy equipment.

Hobby farm rules farm business. Farm Bureau members are asked to act by March 22 at 5 pm. Michigan Department of Treasury 3372 Rev.

Sales tax is set at 6 percent in the state of Michigan for all taxable retail sales with some concessions however. Michigan offers sales tax exemptions to people working in agriculture. You should never use your.

If the Legislature doesnt act to clarify that the existing agriculture. There is no such thing as a Sales Tax Exemption Number for agriculture. Form 3372 Michigan Sales and Use Tax Certificate of Exemption is used in claiming exemption from Michigan sales and use.

In order to claim exemption the nonprofit organization must provide the seller with both. 01-21 Michigan Sales and Use Tax Certificate of Exemption.

February 2022 Sales Tax Rate Changes

2017 2022 Form Tx Comptroller 01 924 Fill Online Printable Fillable Blank Pdffiller

Form 2599 Michigan Fill Out Sign Online Dochub

Michigan State Taxes 2021 Income And Sales Tax Rates Bankrate

Sales Taxes In The United States Wikipedia

Agricultural Sales Tax Exemptions In Florida Florida Farm Bureau

Tax Exemption Tractor Supply Co

Michigan Sales Tax Guide For Businesses

The Tax Break For Kansas Farmers That Few Know About Kcur 89 3 Npr In Kansas City

Sales Tax Information At Steiner Tractor Parts

Michigan Sales Tax Compliance Agile Consulting

How To Get A Wisconsin Sales Tax Exemption Certificate Startingyourbusiness Com

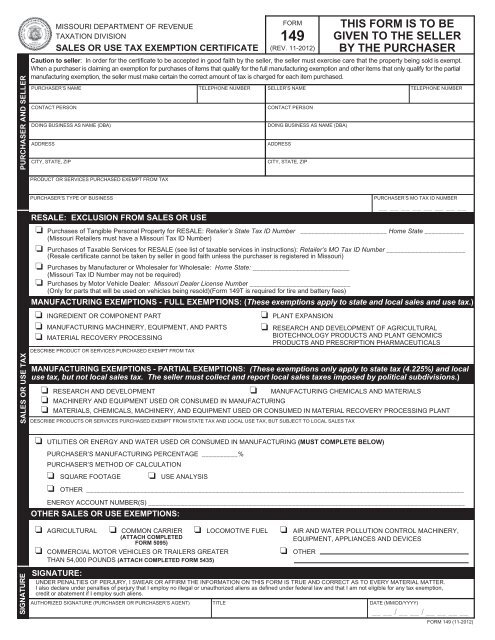

Form 149 Sales And Use Tax Exemption Certificate Missouri

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Sales And Use Tax Regulations Article 3

Michigan Real Estate Sales Tax Determination Of Property S Taxability